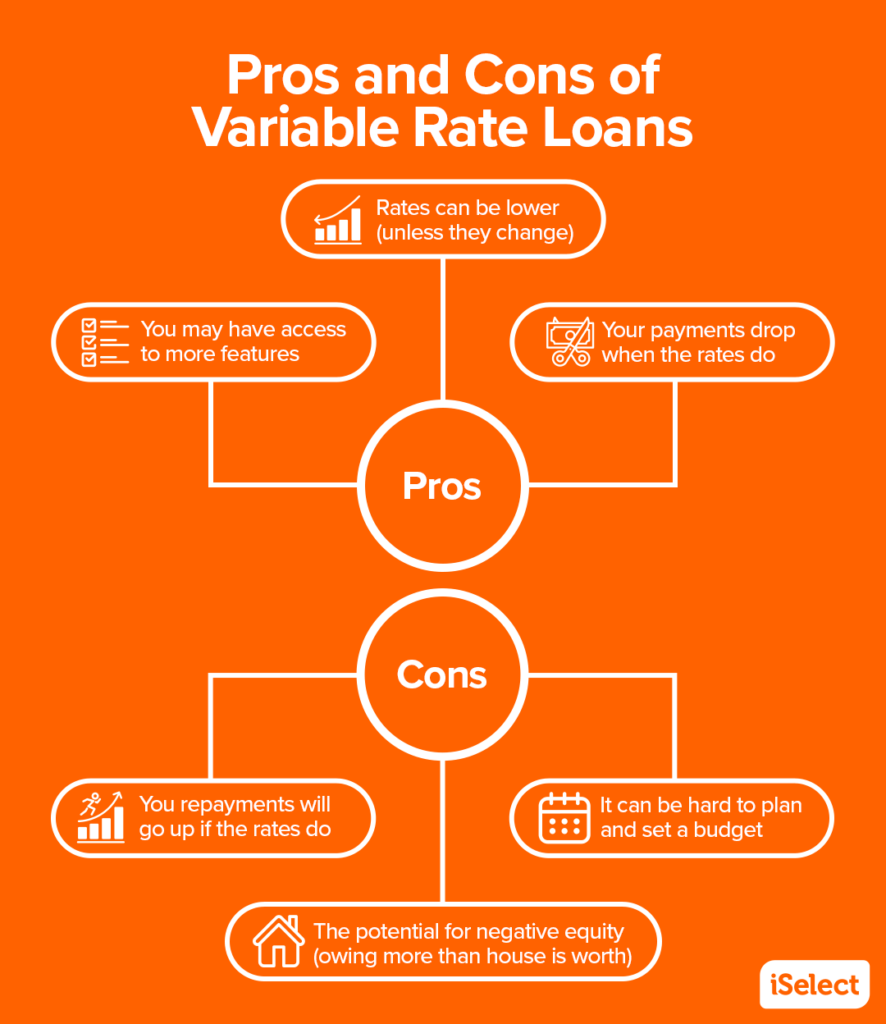

When it comes to securing financing, understanding the nuances of interest rates is critical. Among the various types of bank loans, variable interest rate loans offer distinct advantages that appeal to many borrowers. Unlike fixed-rate loans, where the interest rate remains constant throughout the loan term, variable interest rate loans fluctuate in accordance with market benchmarks. This dynamic nature introduces both opportunities and risks.

This detailed article explores the advantages of variable interest rate bank loans, highlighting why they can be a smart choice for borrowers who want flexibility, potential savings, and adaptability in their financing arrangements.

What Is a Variable Interest Rate Bank Loan?

A variable interest rate bank loan is a loan where the interest rate applied to the outstanding principal changes periodically, often tied to an index or benchmark rate such as the prime rate, LIBOR, or SOFR. As these benchmark rates change, the loan’s interest rate adjusts accordingly, usually at pre-defined intervals.

Key Advantages of Variable Interest Rate Bank Loans

1. Potential for Lower Initial Interest Rates

Variable rate loans typically start with lower interest rates compared to fixed-rate loans. This lower starting point can reduce the borrower’s initial monthly payments, making it more affordable at the outset.

2. Opportunity to Benefit from Falling Interest Rates

When market interest rates decline, borrowers with variable interest rate loans enjoy automatic reductions in their loan interest rate. This can translate to significant savings over time, as the loan repayments decrease without the need to refinance.

3. Greater Flexibility in Loan Management

Variable rate loans often come with fewer penalties for early repayment or refinancing. Borrowers can take advantage of lower rates by refinancing or paying off the loan early when market conditions are favorable.

4. Transparency and Market-Driven Pricing

Because variable rates are tied to widely recognized indices, borrowers can easily monitor interest rate trends and anticipate changes. This transparency helps borrowers plan their finances more effectively.

5. Suitable for Short to Medium-Term Borrowers

Borrowers who plan to repay loans quickly can leverage the initial low rates of variable interest loans without being significantly affected by potential future rate hikes.

6. Encourages Responsible Borrowing and Market Awareness

The fluctuating nature of variable interest rates encourages borrowers to stay informed about market conditions, interest rate trends, and economic indicators, fostering better financial discipline.

When Are Variable Interest Rate Loans Most Advantageous?

- During Periods of Declining or Stable Interest Rates: Borrowers can capitalize on lower rates, reducing overall interest expenses.

- For Borrowers with Strong Cash Flow: Those who can handle occasional rate increases without financial strain benefit from the lower initial costs.

- For Short-Term Financing Needs: If the loan will be repaid before expected rate increases, the variable rate loan can be more cost-effective.

- For Strategic Borrowers: Those comfortable with some degree of risk and looking to optimize borrowing costs in a dynamic market.

Comparison with Fixed Interest Rate Loans

| Feature | Variable Interest Rate Loans | Fixed Interest Rate Loans |

|---|---|---|

| Initial Interest Rate | Usually lower | Usually higher |

| Rate Changes | Fluctuates based on market indices | Remains constant |

| Monthly Payments | Can vary with interest rate changes | Fixed and predictable |

| Potential Savings | Possible if rates decline | No savings from rate drops |

| Risk | Interest rate and payments can increase | Stable, predictable payments |

Tips for Managing Variable Interest Rate Loans

- Monitor Interest Rate Trends: Keep a close eye on market rates and economic indicators.

- Budget for Rate Increases: Maintain a financial cushion to absorb potential payment hikes.

- Understand the Loan Terms: Know how frequently the rate adjusts, caps, and floors.

- Consider Rate Caps: Some loans have maximum interest rates to limit risk.

- Communicate with Your Lender: Regularly discuss loan status and refinancing options.

Conclusion

Variable interest rate bank loans offer significant advantages, especially the potential for lower initial costs and savings when market rates decline. Their flexible, market-responsive nature can be ideal for borrowers who are financially savvy and prepared to manage interest rate fluctuations. By understanding how these loans work and adopting prudent financial practices, borrowers can leverage variable interest rate loans to optimize their financing and reduce borrowing costs.